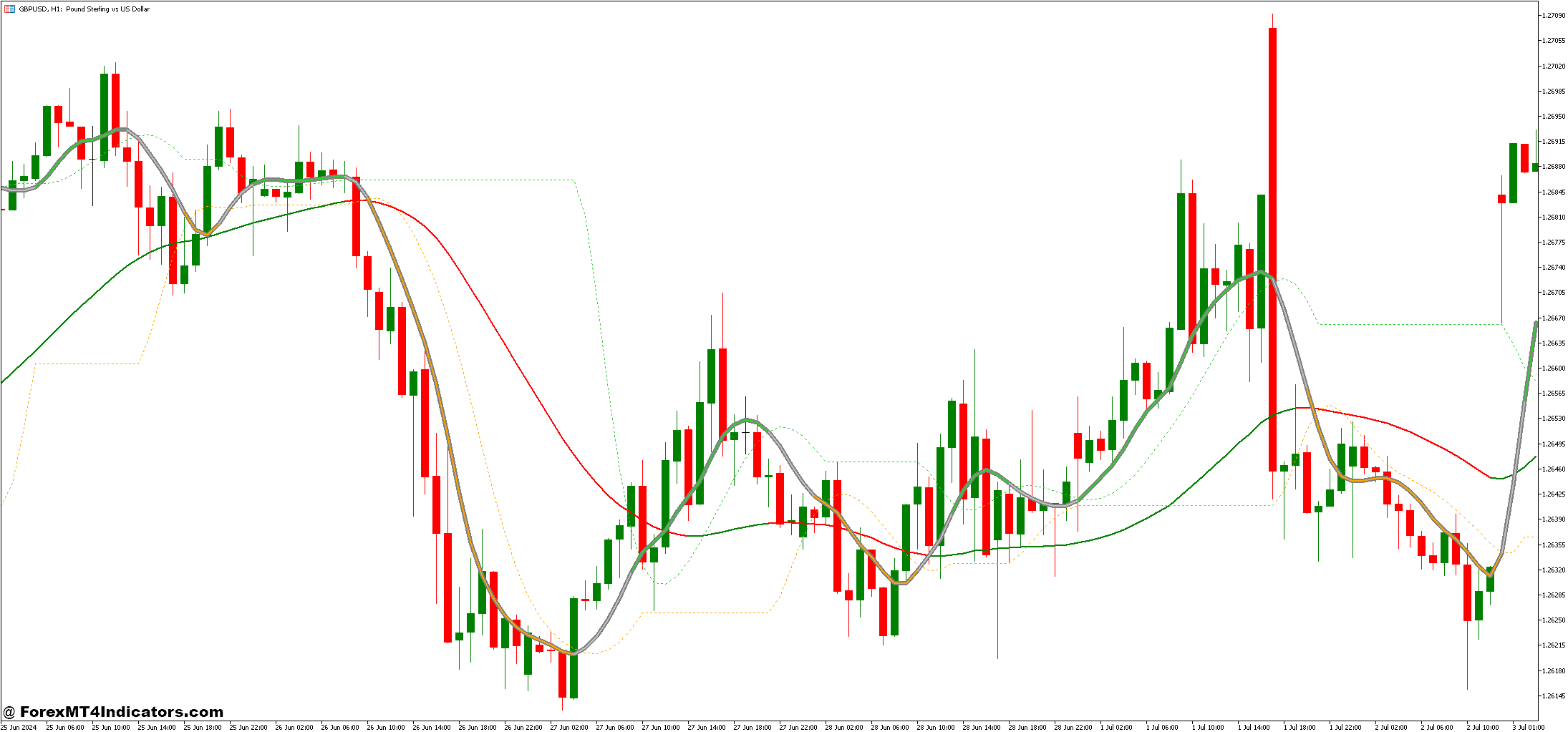

The Slope Direction Line and Super Smoother Levels Forex Trading Strategy represents a sophisticated approach to navigating the complexities of the Forex market. By harnessing the power of the Slope Direction Line (SDL), traders can accurately gauge market trends, while the Super Smoother Levels indicator enhances this analysis by filtering out market noise. This combination allows traders to make more informed decisions, capitalizing on both trend direction and price stability.

At its core, the Slope Direction Line provides a visual representation of the current market trend, indicating whether a currency pair is in an upward or downward trajectory. By measuring the slope of price movements over a designated period, the SDL equips traders with a clear understanding of trend strength. When paired with the Super Smoother Levels, which minimizes short-term fluctuations to reveal longer-term price movements, this strategy empowers traders to identify potential entry and exit points with greater precision.

In a market characterized by rapid changes and unpredictable shifts, the Slope Direction Line and Super Smoother Levels strategy stands out as a valuable tool for Forex traders. By focusing on the interplay between these two indicators, traders can enhance their ability to spot trend reversals and continuations, thereby improving their overall trading performance. As we explore the intricacies of this strategy, we will delve into its essential components, practical applications, and tips for maximizing its effectiveness in various trading scenarios.

Slope Direction Line Indicator

The Slope Direction Line (SDL) indicator is a powerful tool designed to provide traders with a clear visualization of market trends. It operates by calculating the slope of price movements over a specified period, allowing traders to identify the direction and strength of a trend effectively. The SDL is typically plotted as a line on the price chart, changing color based on the trend’s direction: for instance, it may appear green during an uptrend and red during a downtrend. This color-coding makes it easy for traders to quickly assess market conditions at a glance.

One of the key advantages of the Slope Direction Line is its ability to filter out market noise, which is often a significant challenge in Forex trading. By focusing on the slope rather than the price itself, the SDL helps traders avoid false signals that can arise from minor price fluctuations. Additionally, the indicator can be adjusted to suit different trading styles and timeframes, making it versatile for both short-term and long-term traders. When used in conjunction with other technical indicators, the SDL can enhance a trader’s ability to make well-informed decisions based on clear trend signals.

Moreover, the Slope Direction Line can serve as a valuable component in a broader trading strategy. Traders often use it to identify potential entry and exit points, confirming trade signals generated by other indicators. For instance, when the SDL aligns with support and resistance levels or other trend indicators, it can provide a stronger confirmation of the trader’s hypothesis, thereby improving the likelihood of successful trades.

Super Smoother Levels Indicator

The Super Smoother Levels indicator is designed to provide traders with a clearer view of price trends by minimizing the effects of volatility and market noise. Unlike traditional moving averages, the Super Smoother Levels utilize a sophisticated smoothing algorithm that reduces lag and reacts more swiftly to price changes. This makes it particularly effective in identifying significant price movements while filtering out minor fluctuations that may lead to false signals. The Super Smoother Levels can be used to set key support and resistance levels, helping traders to make more informed decisions regarding entry and exit points.

One of the standout features of the Super Smoother Levels is its adaptability to various market conditions and trading styles. Traders can customize the settings to suit different timeframes, enabling them to apply the indicator effectively across short-term scalping, medium-term day trading, or long-term investing strategies. This flexibility allows traders to maintain a consistent approach, regardless of their specific market focus.

Additionally, the Super Smoother Levels indicator can be combined with other technical indicators to enhance overall trading strategies. When used alongside the Slope Direction Line, for example, it provides a more comprehensive analysis of market conditions. The Super Smoother Levels can confirm trends indicated by the SDL, helping traders to identify optimal trade setups and reinforcing the strength of their trading signals. This synergy between indicators creates a robust framework that can lead to more successful trading outcomes in the dynamic Forex market.

How to Trade with Slope Direction Line and Super Smoother Levels Forex Trading Strategy

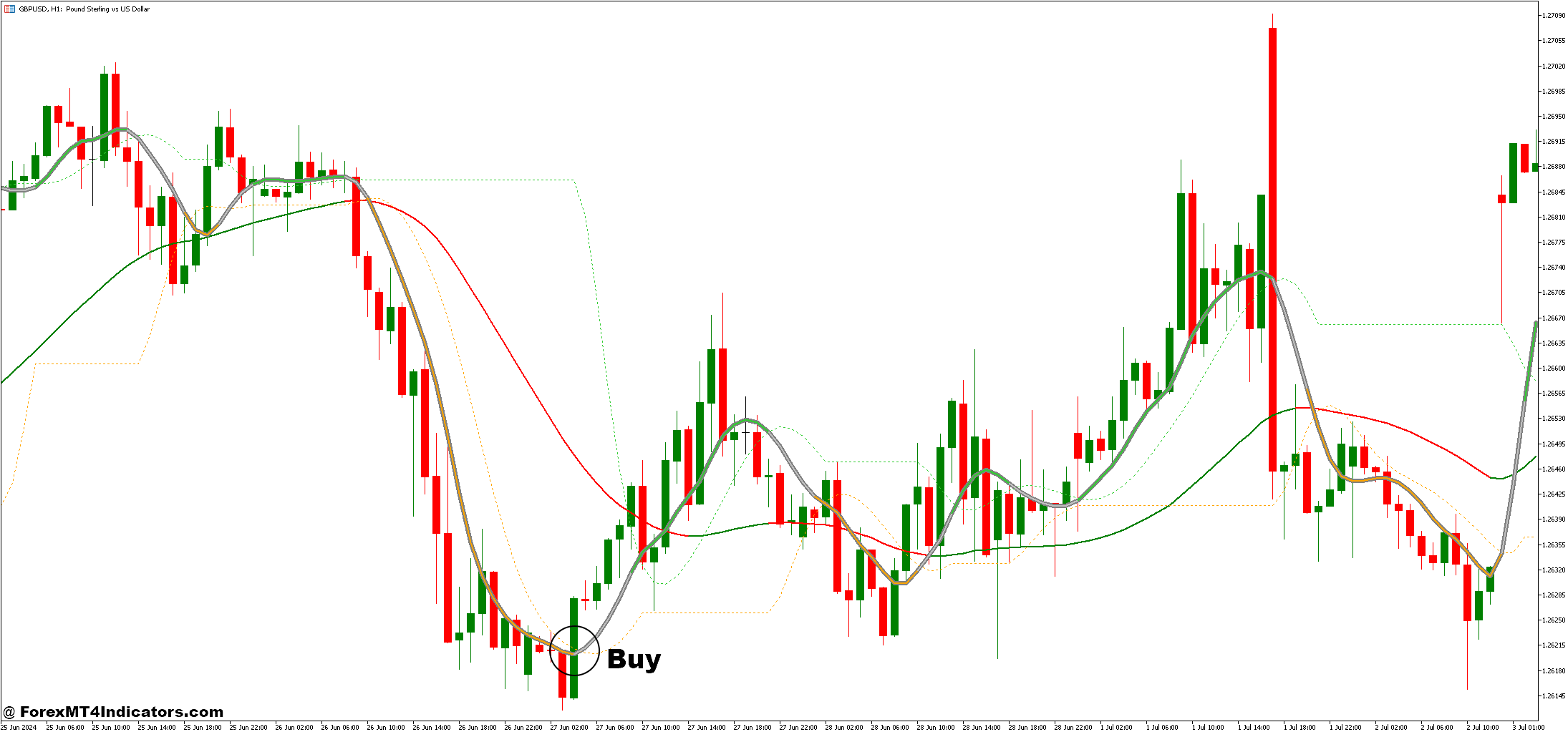

Buy Entry

- Identify Uptrend: Ensure the Slope Direction Line (SDL) is green and moving upwards.

- Price Crossover: Wait for the price to cross above the Super Smoother Levels.

- Confirmation: Look for additional confirmation, such as support levels or positive market sentiment.

- Set Stop-Loss: Place a stop-loss order just below the Super Smoother Level to manage risk.

- Take-Profit Target: Set a take-profit level at key resistance zones or a risk-reward ratio that aligns with your trading strategy.

Sell Entry

- Identify Downtrend: Ensure the Slope Direction Line (SDL) is red and moving downwards.

- Price Crossover: Wait for the price to cross below the Super Smoother Levels.

- Confirmation: Look for additional confirmation, such as resistance levels or negative market sentiment.

- Set Stop-Loss: Place a stop-loss order just above the Super Smoother Level to manage risk.

- Take-Profit Target: Set a take-profit level at key support zones or a risk-reward ratio that aligns with your trading strategy.