Trading any kind of tradeable instrument, whether it be in the stock market, indices, bonds or commodities, is a difficult endeavor. Trading the forex market is a different beast. The forex market is probably one of the most difficult types of trading market that traders could dabble with. This is because unlike the above aforementioned tradeable instruments, currency pairs entail that traders are trading in a tug of war of supply and demand between two currencies.

For example, a trader is looking to trade the EUR/USD pair. There are several factors that could occur. The EUR might gain demand and cause the pair to rise. Another scenario would a strong demand for the USD causing the price of the pair to drop. The opposite could also happen, which is a weakness in the EUR, which should cause price to drop. It could also be a weakness of the USD, which should cause the price of the pair to rise. It could also be a strength in both currencies or a weakness in both currencies which would cause price to stagnate or create a choppy condition. All these scenarios could come into play, which is what makes trading the forex market a tad more difficult than other tradeable instruments.

Traders need tools to simplify trading. A few simple technical indicators can make all the difference. It could make an unintelligible price chart make more sense and give new traders the needed confidence to trade the forex market.

Ichimoku Kinko Hyo – Kumo

Ichimoku Kinko Hyo is a unique technical indicator because it is composed of several indicators that work coherently as a whole system. It is composed of several average lines which are based on the mean of price in a given time period. It is composed of five lines that indicate the direction of the trend.

The Tenkan-sen or conversion line is computed as the median of price over the past nine periods. This line represents the short-term trend.

The Kijun-sen or base line is computed as the median of price over the past 26 periods. This line represents the mid-term trend.

The Chikou Span or lagging span is the current periods closing price plotted 26 periods back. This line represents the movement of price action.

Senkou Span A or leading span A is the median of the Tenkan-sen and Kijun-sen plotted 26 periods ahead.

Senkou Span B or leading span B is the median of price over the past 52 periods plotted 26 periods ahead.

Combined together, Senkou Span A and B form the Kumo or cloud. The Kumo represent the long-term trend.

The Kumo is an excellent long-term trend direction filter. It clearly indicates the direction of the long-term trend and tends to act as a very good dynamic area of support or resistance.

Qualitative Quantitative Estimation

Many traders are out looking for the “Holy Grail” of technical indicators. Many claim to have found it when they stumbled upon the QQE.

Qualitative Quantitative Estimation (QQE) is a momentum technical indicator which is an oscillator.

It plots two lines which oscillate around its midline, which is 50. Lines below 50 indicate a bearish bias, while lines above 50 indicate a bullish bias. However, if the lines are extended far from 50, there is a good chance that price might be overextended and could reverse back to its mean. Trend direction can also be indicated based on how the two lines overlap. Crossovers between the two lines indicate a potential momentum reversal.

It behaves much like the Relative Strength Index (RSI) since it also mimics the movement of price action very closely. However, unlike the RSI, the QQE is less reactive to price action fluctuations and tends to be much smoother.

Trend reversal signals indicated by the crossing over of the two QQE lines tend to be very accurate. Although it is not perfect and therefore could not be considered the Holy Grail of indicators, it is still very accurate and would be a great tool for trading the forex market.

Trading Strategy

Kumo QQE Forex Trading Strategy is a simple trend following strategy which trades on confluences between the Kumo of the Ichimoku Kinko Hyo indicator and the QQE.

In this setup, all the other Ichimoku Kinko Hyo lines are made invisible and only the Kumo is left. The Kumo is used to identify the long-term trend and is therefore the trade direction filter. Trades should only be taken in the direction indicated by the Kumo.

Price pull backs occur every now and then on a trending market. This should cause the QQE lines to temporarily reverse. Trades are taken as soon as the two QQE lines crossover indicating the resumption of the trend.

Indicators:

- Ichimoku Kinko Hyo

- QQE

Preferred Time Frames: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

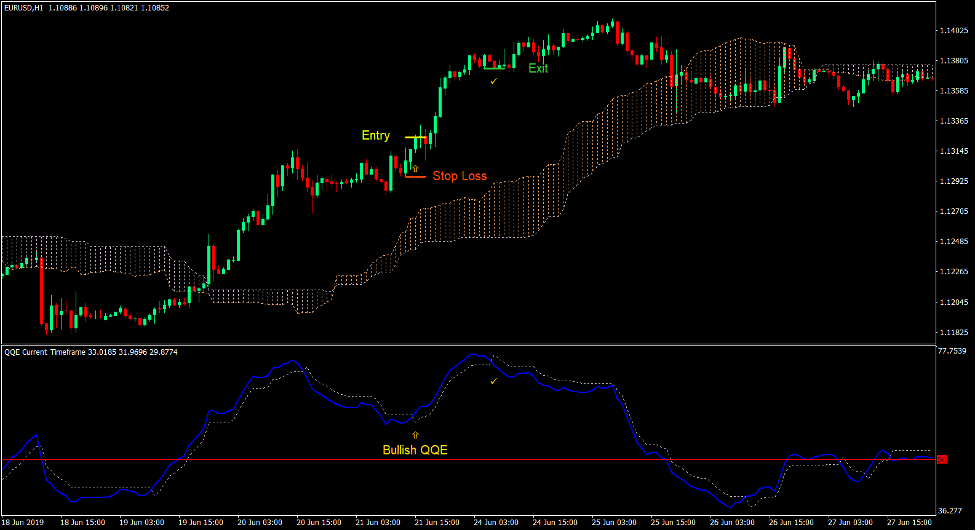

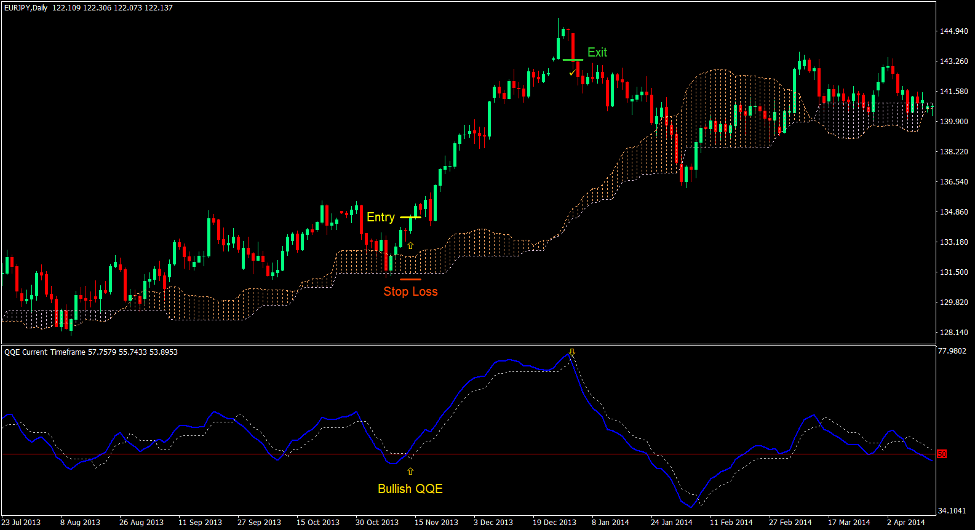

Buy Trade Setup

Entry

- Price action should be above the Kumo.

- The Kumo should be sandy brown.

- The QQE lines should be above 50.

- Price should pull back towards the Kumo causing the blue QQE line to cross below the dotted QQE line.

- Enter a buy order as soon as the blue QQE line crosses above the dotted QQE line.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as the blue QQE line crosses below the dotted QQE line.

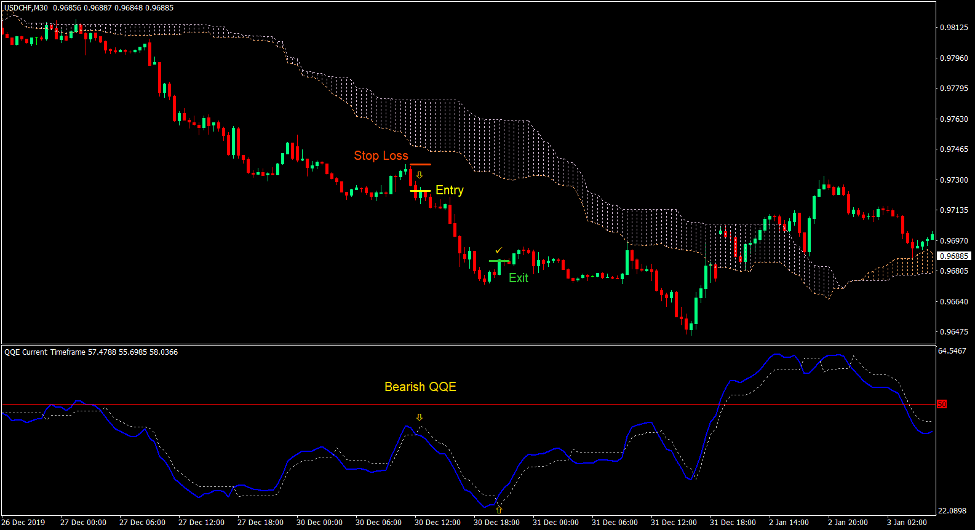

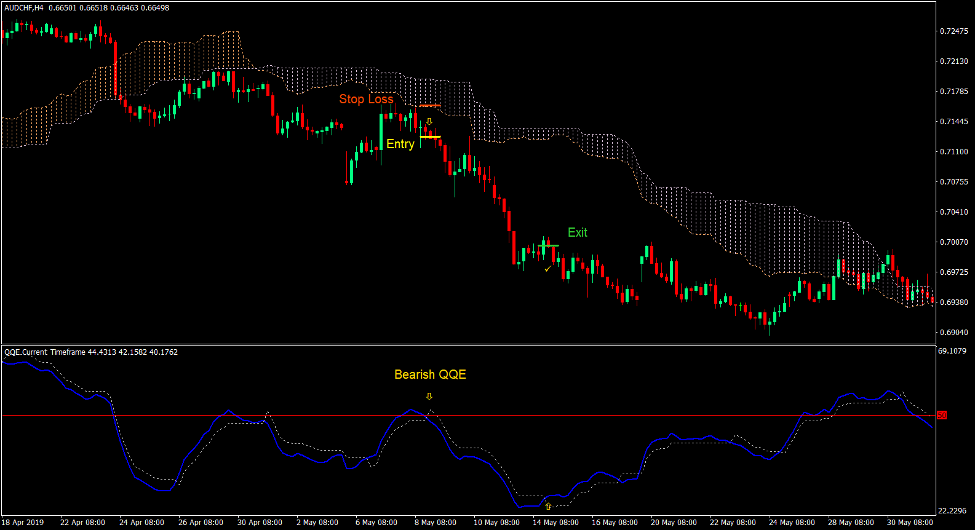

Sell Trade Setup

Entry

- Price action should be below the Kumo.

- The Kumo should be thistle.

- The QQE lines should be below 50.

- Price should pull back towards the Kumo causing the blue QQE line to cross above the dotted QQE line.

- Enter a sell order as soon as the blue QQE line crosses below the dotted QQE line.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as the blue QQE line crosses above the dotted QQE line.

Conclusion

This trading strategy is a good mid-term trend following strategy.

The combination of the Kumo, which represents the long-term trend, as well as the confirmation of the QQE being above or below 50 helps traders clearly identify the direction of the trend.

Trade signals produced by the QQE crossover also tend to be very accurate. Add to it the fact that the trades are taken only in the direction of the trend, trade setups tend to become high probability setups.

Forex Trading Strategies Installation Instructions

Kumo QQE Forex Trading Strategy is a combination of Metatrader 4 (MT4) indicator(s) and template.

The essence of this forex strategy is to transform the accumulated history data and trading signals.

Kumo QQE Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust this strategy accordingly.

Recommended Forex MetaTrader 4 Trading Platform

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click Here for Step-By-Step XM Broker Account Opening Guide

How to install Kumo QQE Forex Trading Strategy?

- Download Kumo QQE Forex Trading Strategy.zip

- *Copy mq4 and ex4 files to your Metatrader Directory / experts / indicators /

- Copy tpl file (Template) to your Metatrader Directory / templates /

- Start or restart your Metatrader Client

- Select Chart and Timeframe where you want to test your forex strategy

- Right click on your trading chart and hover on “Template”

- Move right to select Kumo QQE Forex Trading Strategy

- You will see Kumo QQE Forex Trading Strategy is available on your Chart

*Note: Not all forex strategies come with mq4/ex4 files. Some templates are already integrated with the MT4 Indicators from the MetaTrader Platform.

Click here below to download: