Are you struggling to make money in forex trading? You’re not alone. The forex market’s high leverage and constant action can lead to frustration and losses. With 90% of traders failing, it’s easy to feel overwhelmed.

But don’t give up yet! By developing a consistent trading strategy and mastering risk management, you can join the ranks of successful forex traders. This guide will show you how to navigate the world’s largest financial market and achieve steady profits.

Key Takeaways

- Develop a consistent trading strategy for long-term success

- Master risk management techniques to protect your capital

- Maintain emotional control and trading discipline

- Use technical analysis tools effectively

- Implement capital preservation strategies

- Continuously analyze market trends and adapt your approach

Understanding the Forex Market Fundamentals

The forex market is huge, much bigger than other markets. Every second, $850 million is traded. This adds up to $7.5 trillion daily, showing how big forex trading is.

The Scale and Scope of Forex Trading

Forex trading happens all day, every day, except weekends. This 24-hour market lets traders act on news anytime. Because of its high liquidity, currencies can be traded without big price changes.

Key Market Participants

Many types of people and groups shape the forex market. These include:

- Banks

- Corporations

- Investment firms

- Central banks

- Individual traders

Each group has its role, making the market complex and deep.

Market Hours and Trading Sessions

Forex trading covers the world, following the sun:

- Asian Session

- European Session

- North American Session

These sessions overlap, creating busy and volatile times. Knowing about these sessions and who trades is key to understanding the market.

Developing a Consistent Trading Strategy

A good forex strategy is key to making money in the fast-changing currency markets. Traders who succeed know that random trading is like gambling. It leads to unpredictable results. By having a clear trading plan and doing deep market analysis, traders can do better.

Think about your trading style and how much risk you can take. Some traders make many trades in a short time. Others take a longer view. For example, scalpers aim for about 10 pips per trade. They look for the best times to trade, like between 8 am – 12 noon EST and 2 am – 4 am EST.

Using technical indicators can make your trading plan better. The Relative Strength Index (RSI) shows when prices are too high or too low. It’s above 70% for overbought and below 30% for oversold. Fibonacci levels at 23.6%, 38.2%, 50%, 61.8%, and 100% help find good times to enter and exit trades.

To stay consistent, keep a trading journal. Write down every trade and what was happening around it. This helps you improve your strategy. A strong forex strategy should change with the market. It might use different methods to make more money while keeping risks low.

Essential Risk Management Techniques

Risk management is key to successful forex trading. It’s not just about making money. It’s also about keeping your capital safe and ensuring long-term success. Let’s look at some important techniques for managing risk in the forex market.

Position Sizing and Leverage Control

Position sizing is very important in forex trading. Professional traders usually risk only 1-2% of their trading balance per trade. This is known as the 1% or 2% rule, which helps protect your account from big losses.

For example, with a $10,000 account, you’d risk no more than $200 per trade using the 2% rule. This means you could lose up to $200 on a trade.

Leverage can be good and bad. It can make profits bigger, but it also increases risk. A 100:1 leverage lets you control a $100,000 position with just $1,000. Be careful with leverage, even if you’re experienced.

Stop-Loss Placement Strategies

Stop-loss orders are vital for managing risk. They close your position automatically when the market moves against you by a set amount. For example, if you buy EUR/USD at 1.2000, you might set a stop-loss at 1.1950.

Risk-Reward Ratio Implementation

A common risk-reward ratio in forex trading is 1:2. This means for every dollar risked, you aim for a profit of two dollars. Using this ratio can help you make money even if you win less than half the time.

For example, if you risk $100 on a trade, your take-profit order should be set to secure $200 in profits. This way, you can make more money than you risk.

By using these risk management techniques all the time, you can keep your trading capital safe. This increases your chances of success in the forex market over the long term.

How to Make Consistent Profits in Forex Trading

Making consistent profits in Forex trading needs strategy, discipline, and always getting better. Successful traders use a systematic trading method. This method fits the market and their goals.

Building a Systematic Approach

A systematic Forex trading method is a structured way to analyze markets and make trades. It includes:

- Setting clear rules for when to enter and exit trades

- Having rules for managing risk

- Picking the right timeframes and currency pairs

Traders with good systems often do well in the market. A good trading system can win 65% of the time. This shows that even with losses, you can stay consistent.

Maintaining Trading Discipline

Trading discipline is key for lasting success. It means following your plan and not making rash decisions. Important parts of discipline include:

- Sticking to your rules for entering and exiting trades

- Following your risk management plan

- Keeping calm during market ups and downs

Performance Monitoring and Adjustment

Tracking your performance is vital for getting better at trading. Traders should:

- Keep a detailed journal of their trades

- Look at their win/loss ratios and average profits

- Change their strategies as needed

Testing your strategy with different currency pairs and timeframes is helpful. It helps you see how well your strategy works. This helps you improve and adjust to market changes.

| Aspect | Importance | Implementation |

|---|---|---|

| Risk Management | Critical | 1-2% rule per trade |

| Emotional Control | High | Maintain discipline and patience |

| Continuous Learning | Essential | Read books, take courses, join communities |

Technical Analysis Tools for Profitable Trading

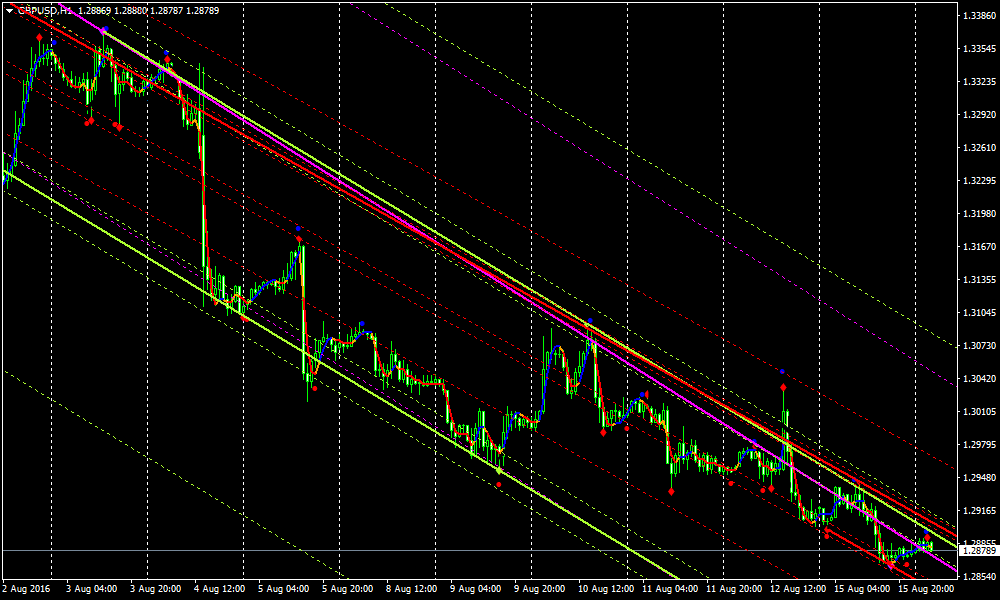

Technical analysis is key for many forex traders. It helps them understand market trends and when to buy or sell. By looking at chart patterns and using indicators, traders make smart choices.

Moving averages are a basic tool in forex analysis. They make price data smooth to show trends over time. Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) are common. EMAs change quickly with price changes, great for short-term traders.

Bollinger Bands® are also important. They change with market volatility. When prices hit the outer bands, it might mean the market is overbought or oversold. This helps traders find when to change their strategy.

The Relative Strength Index (RSI) shows how fast and how much prices are moving. An RSI above 70 means the market might be overbought. Below 30 means it’s oversold. Traders use this to find when trends might change or continue.

| Indicator | Function | Key Levels |

|---|---|---|

| Moving Averages | Trend identification | Varies (e.g., 50-day, 200-day) |

| Bollinger Bands | Volatility measurement | Upper and lower bands |

| RSI | Momentum measurement | 30 (oversold), 70 (overbought) |

These tools are very useful but don’t make things too complicated. Using a few good indicators and recognizing chart patterns is a strong strategy. The secret to making money is to keep practicing and always learn more.

Psychology of Successful Trading

Trading psychology is key to forex success. Emotional control and confidence are what set winners apart from losers. Let’s dive into the mind games that shape your trading journey.

Emotional Control in Trading

Controlling emotions is essential for making money. Fear and greed can ruin your plans. Fear makes you close deals too soon, missing big wins. Greed, on the other hand, can lead to big losses.

Dealing with Losses

Losses are a part of trading. Winners accept them and keep moving forward. Using stop-loss orders and keeping a journal helps manage emotions and learn from mistakes.

Building Trading Confidence

Confidence grows with knowledge and experience. Learning more about forex trading helps you make better choices. Sticking to a plan and using automated tools can also help.

| Psychological Factor | Impact on Trading | Mitigation Strategy |

|---|---|---|

| Fear | Premature position closure | Set clear exit strategies |

| Greed | Over-leveraging | Strict risk management rules |

| Overconfidence | Excessive risk-taking | Regular performance review |

| Frustration | Revenge trading | Take breaks after losses |

By tackling these mental challenges, traders can build the mental strength needed for success in forex.

Capital Preservation Strategies

Keeping your capital safe is key to success in forex trading. Smart traders aim for steady growth, not quick profits. Let’s look at good ways to keep your capital safe in the forex market.

Account Balance Management

Managing your account balance well is very important. Traders should not risk too much to keep their money safe. The 2% rule is a good guide, not risking more than 2% of your capital on one trade.

This rule helps avoid big losses and keeps you trading for a long time.

Drawdown Prevention

Managing drawdowns is key to avoiding big losses. Using stop-loss orders can close trades at set prices, controlling losses. It’s also smart to set a max drawdown, deciding how much loss you can take before acting.

Recovery Techniques

When you lose money, there are ways to get back on track. The 5-3-1 forex trading rule helps. It means focusing on five currency pairs, three strategies, and one trading period.

This helps you regain confidence and consistency. Also, using the right position sizes and not overusing leverage is important for getting your account back.

| Strategy | Description | Benefit |

|---|---|---|

| 2% Rule | Risk no more than 2% of capital per trade | Limits possible losses |

| Stop-Loss Orders | Automatic trade closure at preset price points | Prevents big losses |

| 5-3-1 Rule | Focus on 5 pairs, 3 strategies, 1 trading period | Improves consistency and recovery |

Market Analysis and Trade Selection

Market analysis is key to successful forex trading. Traders need to understand the economic forces that affect currency values. They study economic indicators like GDP, inflation rates, and employment figures.

These metrics show a country’s economic health. They help figure out a currency’s strength.

Trade selection depends on correctly interpreting these indicators. For example, a rising GDP means a stronger currency. However high inflation can make a currency weaker.

Traders use this knowledge with technical analysis. This helps them find the best times to buy or sell.

Central bank decisions are very important in forex markets. Changes in interest rates can cause big movements in currency values. Traders who know about these changes can predict market trends better.

Choosing trades wisely also means knowing the risks. A good strategy is to aim for a profit that’s at least three times the loss. This way, even with fewer wins, traders can stay profitable.

Remember, making money in forex trading takes patience and discipline. Stick to your plan and don’t make rash decisions. Keep improving your analysis skills. With time, you’ll spot high-probability trades in this fast-changing market.

Advanced Trading Techniques

As forex traders get better, they look into more complex strategies to make more money. Let’s explore some advanced trading techniques. They can help you do well in the $7.5 trillion daily forex market.

Trend Following Strategies

Trend trading uses market movements to make money. Traders look for strong trends to follow. This can lead to big profits if the trend keeps going.

Breakout Trading Methods

Breakout trading happens when prices go past a certain level. It works well when markets are very active. This can be during big economic news that changes currency values by 1-2%.

Counter-Trend Approaches

Counter-trend strategies try to make money when the market might change direction. They are riskier but can pay off well if done right. Traders who use both technical and fundamental analysis in these strategies do 30% better than those who only use one.

It’s important to keep a good risk-reward ratio, no matter your strategy. Many pros aim for a 1:3 ratio. This means risking one unit for every three units of possible gain. This, along with smart position sizing, can boost your trading success.

Conclusion

Making consistent profits in forex needs a mix of strategy, discipline, and always getting better. The forex market, with over $6 trillion traded daily, is full of chances for smart traders. But, the journey to success is tough, with 80% of new traders failing in their first year.

To succeed, traders must take a complete approach. A clear trading plan can help achieve profit goals by 50%. Using strong risk management, like limiting risk to 1% per trade, can cut losses by up to 30%. Focusing on the trading process over quickly is key for lasting success.

Keeping emotions in check is vital, with disciplined traders making up to 40% more than impulsive ones. Keeping a trading journal can boost performance by about 20% over time. With 10 hours a week of learning and analysis, these habits are the foundation of lasting success in forex.

In summary, while the forex market’s 24/5 availability and big price swings are tempting, making consistent profits takes hard work. By sticking to solid strategies, managing risks, and always learning, traders can aim for lasting success in this fast-changing financial world.