The Forecast Oscillator, often abbreviated as FOSC, is a technical analysis indicator specifically designed for the MT4 platform. Developed by the ingenious Tushar Chande, it’s an extension of the Time Series Forecast (TSF) method, a concept that aims to predict future price movements based on past data.

Here’s a quick historical tidbit: Chande, a pioneer in the field of technical analysis, authored numerous books and indicators, including the ever-popular Stochastic Oscillator. So, you can be confident that the FOSC is a product of a well-respected mind in the trading world.

Understanding the Calculation of the Forecast Oscillator

But how exactly does the FOSC work? Let’s peek under the hood and unveil its secrets. The indicator compares the actual closing price of an asset with the value predicted by the TSF. This predicted value essentially represents the endpoint of a linear regression line generated based on historical price data.

Here’s the technical breakdown:

- The FOSC is expressed as a percentage.

- When the closing price aligns perfectly with the TSF prediction, the FOSC value sits at zero. This signifies a state of equilibrium in the market’s sentiment.

- When the closing price surpasses the TSF prediction (indicating a potential upward trend), the FOSC value climbs above zero and ventures into positive territory.

- Conversely, if the closing price falls short of the TSF prediction (suggesting a possible downward trend), the FOSC dips below zero and enters negative territory.

By observing the FOSC’s movements, you can gain valuable insights into the market’s direction and potential turning points.

Customization Options for the Forecast Oscillator

The beauty of the FOSC lies in its adaptability. MT4 allows you to customize various parameters to tailor the indicator to your specific trading strategy and preferences. Here’s a breakdown of the key customization options:

- Moving Average Length: This setting determines the timeframe used by the TSF to generate its prediction. A shorter timeframe emphasizes recent price movements, making the FOSC more responsive but prone to volatility. Conversely, a longer timeframe smooths out fluctuations and offers a more long-term perspective, albeit with potentially delayed signals.

- Overbought/Oversold Levels: Similar to other oscillators, the FOSC can be configured with overbought and oversold levels. These thresholds, typically set at +50 and -50 respectively, represent areas where the market might be overextended in either direction. Reaching these levels could indicate potential trend reversals or retracements. However, it’s crucial to remember that these levels serve as guidelines, not absolute rules.

Pro Tip: Experiment with different FOSC settings in a demo account before deploying them with real capital. This hands-on approach allows you to observe how the indicator behaves under various market conditions and fine-tune it to your trading style.

Trading Signals with the Forecast Oscillator

Now that we understand the FOSC’s mechanics, let’s explore how it can generate trading signals:

- Crossovers Above/Below Zero Line: A basic yet powerful signal involves monitoring the FOSC’s movement around the zero line. When the FOSC crosses above zero from below, it might suggest a potential buying opportunity as the price rallies above the TSF prediction. Conversely, a crossover below zero from above could hint at a selling opportunity as the price dips below the predicted value.

- Divergence Between Price and Oscillator: This strategy involves observing discrepancies between the FOSC’s movement and the underlying price action. For instance, a bullish divergence occurs when the price creates lower lows while the FOSC forms higher lows, potentially foreshadowing an impending trend reversal upwards. Conversely, a bearish divergence emerges when the price forms higher highs while the FOSC carves out lower highs, suggesting a possible trend reversal downwards.

Remember, these signals are best used in conjunction with other technical indicators and fundamental analysis to confirm trading decisions and mitigate risk.

Advantages and Limitations of the Forecast Oscillator

Every tool in a trader’s arsenal has its own strengths and weaknesses. Let’s delve into the advantages and limitations of the FOSC to help you decide if it aligns with your trading approach.

Advantages

- Early Warning Signals: The FOSC’s ability to compare the closing price with the TSF prediction can provide early indications of potential trend shifts. This heads-up can be invaluable for traders seeking to capitalize on emerging market opportunities.

- Customizable Settings: As discussed earlier, the FOSC’s adaptability allows you to tailor it to your trading style and risk tolerance. By adjusting the moving average length and overbought/oversold levels, you can refine the indicator’s sensitivity and generate signals that resonate with your trading strategy.

- Complementary to Other Tools: The FOSC integrates seamlessly with other technical indicators, such as moving averages, MACD, and Bollinger Bands. By incorporating the FOSC’s insights alongside these established tools, you can build a more robust trading framework for informed decision-making.

Limitations

- False Signals: No indicator is perfect, and the FOSC is no exception. Market noise and random fluctuations can sometimes trigger misleading signals. Remember, the FOSC is just one piece of the puzzle; always consider other factors before pulling the trigger on a trade.

- Lagging Indicator: The FOSC relies on historical data to generate its predictions. This inherent characteristic can lead to some lag, meaning the indicator might react with a slight delay to price movements. This is where using the FOSC in conjunction with leading indicators can be beneficial.

- Overreliance on Predictions: While the TSF prediction is a valuable tool, it’s important not to become overly reliant on it. The market is inherently dynamic, and unforeseen events can derail even the most meticulously crafted predictions.

Integrating the Forecast Oscillator with Other Trading Tools

The FOSC isn’t meant to operate in isolation. Its true power unfolds when combined with other technical analysis tools. Here are some effective integration strategies:

- Combining with Trend Indicators: Pairing the FOSC with established trend indicators like moving averages can provide a more comprehensive picture of the market’s direction. For example, if the FOSC generates a buy signal while a moving average confirms an uptrend, the confluence of these signals strengthens the trading opportunity’s credibility.

- Using Alongside Support/Resistance Levels: Support and resistance levels represent areas where the price tends to find temporary pauses or reversals. When the FOSC coincides with a support or resistance level, it can bolster the significance of a potential breakout or breakdown, offering valuable confirmation for your entry or exit points.

How to Trade With The Forecast Oscillator

Buy Entry

- Crossover Above Zero: Look for the FOSC line to cross above the zero line from below. This suggests a potential uptrend as the price rallies above the TSF prediction.

- Entry: Consider entering a long position (buying) shortly after the crossover is confirmed.

- Stop-Loss: Place a stop-loss order below the recent swing low or support level, depending on your risk tolerance.

- Take-Profit: Take-profit levels can vary depending on your strategy and market conditions. Here are two options:

- Target a specific percentage gain (e.g., 5% or 10%).

- Look for the FOSC to reach overbought territory (typically above +50) and consider exiting the trade.

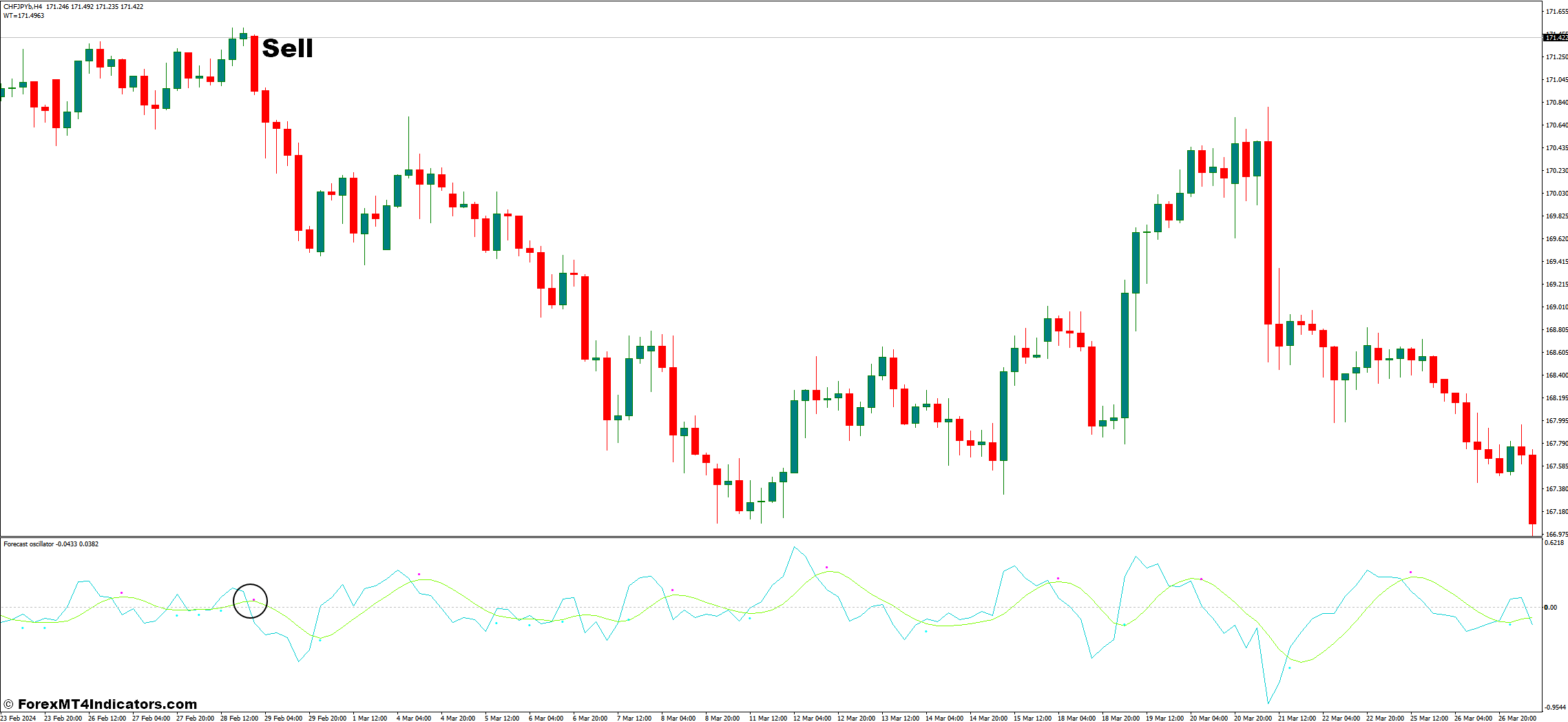

Sell Entry

- Crossover Below Zero: Conversely, watch for the FOSC line to cross below the zero line from above. This could indicate a downtrend as the price falls below the TSF prediction.

- Entry: Consider entering a short position (selling) shortly after the crossover is confirmed.

- Stop-Loss: Place a stop-loss order above the recent swing high or resistance level, depending on your risk tolerance.

- Take-Profit: Similar to buying, take-profit levels can be tailored to your strategy:

- Target a specific percentage gain (e.g., 5% or 10%).

- Look for the FOSC to reach oversold territory (typically below -50) and consider exiting the trade.

Forecast Oscillator Indicator Settings

Conclusion

The Forecast Oscillator stands as a valuable tool within the MT4 trader’s toolkit. By understanding its calculation, customization options, and the types of signals it generates, you can leverage its strengths to identify potential trading opportunities and navigate the ever-changing market landscape. Always prioritize sound risk management practices, employ a confluence of technical and fundamental analysis, and hone your trading psychology to make informed decisions in the dynamic world of financial markets.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 50% Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐