The Candles Color and RSI Divergence Forex Trading Strategy is a method that combines visual candlestick patterns with one of the most reliable momentum indicators, the Relative Strength Index (RSI). Candlestick colors help traders quickly gauge market sentiment—whether the market is bullish or bearish—by simply looking at how the candles change in sequence. Meanwhile, RSI divergence acts as a leading indicator, identifying potential reversals in price trends by showing a disconnect between price movement and RSI momentum. Together, these tools create a synergy that helps traders make more informed decisions.

In Forex trading, timing is everything. Spotting reversals early can mean the difference between a successful trade and a missed opportunity. The RSI Divergence is particularly useful in identifying these moments, signaling when the market’s current trend may be losing strength. By focusing on divergences between price and RSI, traders can pinpoint moments when market momentum is weakening or gaining, often before the price itself reflects this change. When combined with candlestick color analysis, which reveals market direction at a glance, this strategy can provide a powerful edge in predicting trend reversals.

This strategy is not only designed to be straightforward for traders at any level, but it also offers clear visual cues that reduce the noise often found in technical analysis. Whether you are a day trader looking for quick opportunities or a swing trader planning longer-term moves, using candlestick color changes alongside RSI divergence signals allows you to trade with confidence, relying on technical indicators that complement one another.

Candles Color Indicator

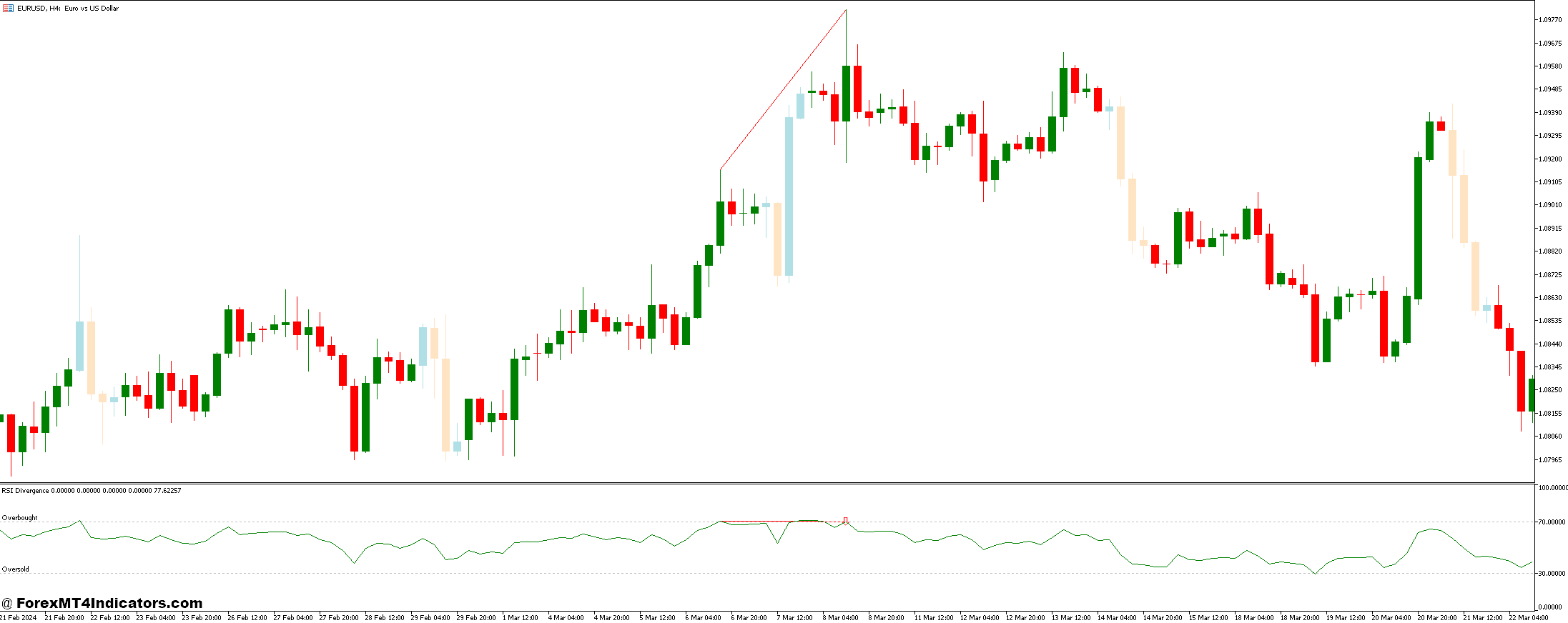

The Candles Color Indicator is a simple yet effective tool that visually enhances candlestick charts by color-coding price movements. This indicator automatically assigns different colors to bullish and bearish candles, making it easier for traders to identify market trends and momentum. Typically, a bullish candle is represented by a green or blue color, indicating that the closing price is higher than the opening price. Conversely, a bearish candle is often red or another contrasting color, signaling that the closing price is lower than the opening price.

What makes the Candles Color Indicator particularly useful is its ability to simplify chart reading. Traders can quickly assess market conditions without needing to dive into complex numerical data. By observing the sequence of colored candles, they can easily determine if the market is trending upwards, downwards, or moving sideways. For example, a series of consecutive green candles suggests strong bullish momentum, while a succession of red candles indicates a bearish trend. This visual approach helps traders react to market changes more efficiently, especially in fast-moving Forex markets.

Furthermore, the Candles Color Indicator works well with other technical tools, providing a clearer context for interpreting price movements. It serves as an excellent complement to indicators like moving averages, oscillators, and, most notably, RSI divergence. By incorporating color-coded candlesticks into your analysis, you gain a better understanding of market sentiment and can make more precise decisions regarding entry and exit points.

RSI Divergence Indicator

The RSI Divergence Indicator is a technical tool that highlights discrepancies between price action and the Relative Strength Index (RSI), a popular momentum oscillator. Divergence occurs when the price of a currency pair moves in one direction while the RSI moves in the opposite direction. This mismatch between price and momentum often signals a potential reversal or correction in the market, making RSI divergence a powerful tool for spotting trend changes before they happen.

RSI Divergence is categorized into two types: regular divergence and hidden divergence. Regular divergence occurs when the price makes higher highs or lower lows, but the RSI shows lower highs or higher lows, indicating weakening momentum and a possible trend reversal. On the other hand, hidden divergence suggests trend continuation when the price pulls back slightly while the RSI makes higher lows (in an uptrend) or lower highs (in a downtrend). Both types of divergence are valuable in providing early warnings about potential market movements.

The strength of the RSI Divergence Indicator lies in its ability to filter out false signals and confirm the market’s underlying momentum. By using this indicator, traders can avoid getting caught in false breakouts or breakdowns, ensuring that they enter trades when the probability of a trend change is high. When combined with the Candles Color Indicator, RSI divergence becomes even more powerful, offering clear visual and technical cues to time entries and exits effectively.

How to Trade with Candles Color and RSI Divergence Forex Trading Strategy

Buy Entry

- Identify an overall downtrend using the Candles Color Indicator (a sequence of red candles).

- Spot bullish divergence on the RSI Divergence Indicator:

- Price is making lower lows, but the RSI is making higher lows.

- Confirm the bullish signal with the Candles Color Indicator:

- Look for the red candles to start turning green, indicating a potential reversal.

- Buy Entry: Enter a buy position after the first green candle closes, confirming the bullish divergence.

- Stop Loss: Place the stop loss just below the most recent swing low.

- Take Profit: Aim for the nearest resistance level or use a trailing stop to lock in profits as the market moves up.

Sell Entry

- Identify an overall uptrend using the Candles Color Indicator (a sequence of green candles).

- Spot bearish divergence on the RSI Divergence Indicator:

- Price is making higher highs, but the RSI is making lower highs.

- Confirm the bearish signal with the Candles Color Indicator:

- Watch for the green candles to start turning red, indicating weakening bullish momentum.

- Sell Entry: Enter a sell position after the first red candle closes, confirming the bearish divergence.

- Stop Loss: Place the stop loss just above the most recent swing high.

- Take Profit: Target the nearest support level or use a trailing stop as the market moves downward.

Conclusion

The Candles Color and RSI Divergence Forex Trading Strategy offers a powerful combination of visual simplicity and technical precision. By leveraging the Candles Color Indicator, traders can easily assess market sentiment and identify trends at a glance. When combined with the RSI Divergence Indicator, which signals potential reversals based on momentum shifts, this strategy enhances the trader’s ability to time market entries and exits more effectively.

Recommended MT4 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 50% Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

Click here below to download: